Our Disability Insurance Lawyers Help You Fight Your Long-Term Disability Denial

Getting a denial letter from your disability insurance company is one of the ultimate insults. You are sick and not able to work, yet your disability insurance company is telling you to return to work. The disability insurance company has denied your disability benefit claim and is basically calling you a liar. When receiving a disability denial letter or a phone call that your disability benefit claim was denied, most claimants initial reaction is a state of shock. The disability insurance company often tells the claimant to just go ahead and submit an appeal of the denial. It’s true that you need to submit an appeal to your disability company, but it’s not something that happens immediately. Don’t face this battle alone. Our disability insurance lawyers are here to help you navigate the complex denial process and fight for the benefits you deserve. Contact us today for a free consultation and let us fight for your rights.

As a law firm that has handled thousands of long-term disability denials, we want you to know what it takes to fight a long-term disability denial. In the video above our long-term disability denial attorneys discuss the following:

- First steps our disability lawyers take when handling a long-term disability denial;

- Why is it so important to do a deep dive into the claim file?

- You must get medical records from every doctor;

- A winning appeal requires you to build strong medical evidence;

- Vocational evidence should be included and an expert could help.

What do you do if you have been denied disability benefits?

You must first determine the type of disability claim denial you have in order to determine the next steps to take. Our law firm helps people that have disability insurance and have either a short term disability claim denial or a long term disability benefit denial. If you have been denied any type of government disability benefits, such as state disability benefit or social security disability benefits (SSDI), then you need the help of a social security disability lawyer. We are short and long term disability denial lawyers and we do not handle any SSDI or state disability benefit denials. In our video below we explain the difference between a long-term disability denial attorney and a social security disability attorney. We only help individuals with disability insurance denials.

ERISA Is a Federal Law You Must Know

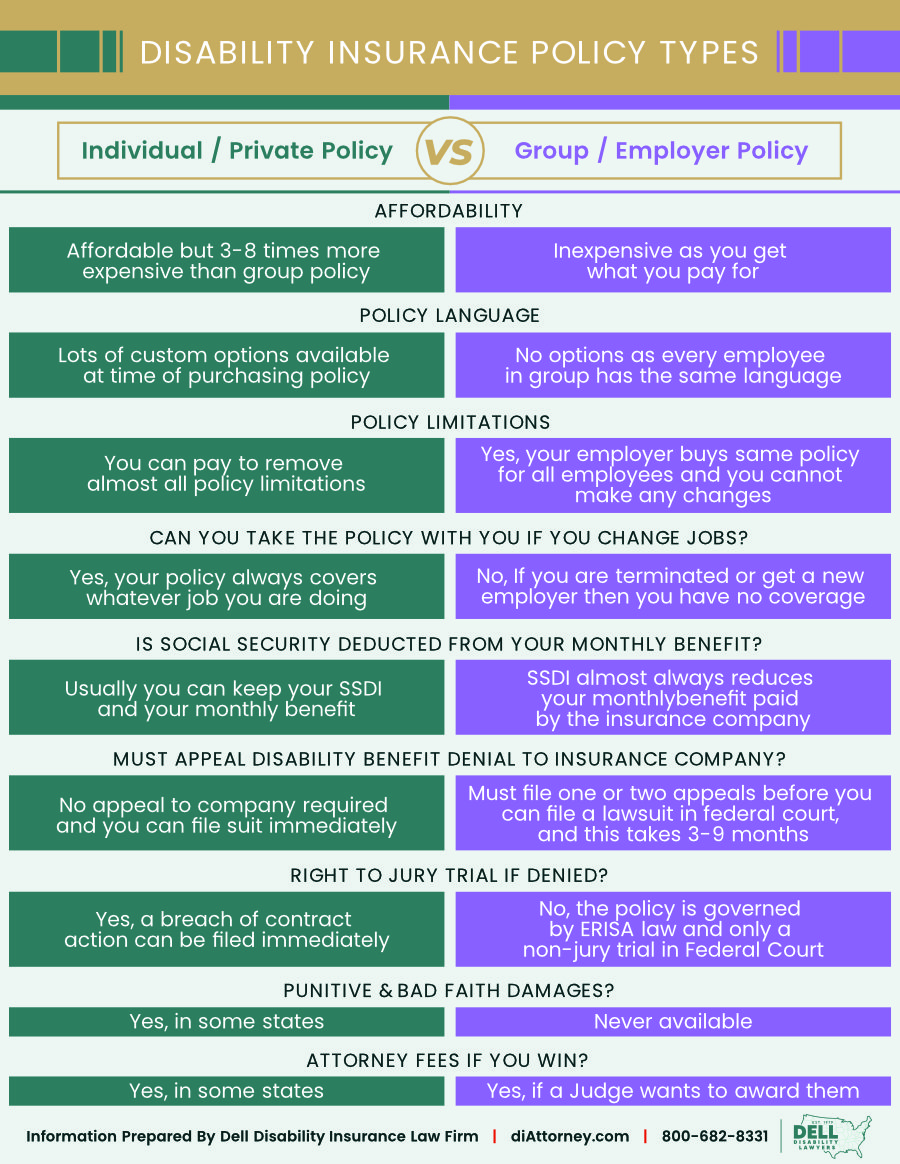

If you have either purchased a disability policy or have disability insurance benefits as an employer provided benefit, then we can help you with your disability insurance denial. If your disability insurance is a benefit from your employer, then your disability benefit denial is governed by ERISA and you must submit a written appeal letter to your disability insurance company. If you purchased your disability policy from a disability insurance company without any involvement from your employer, then you have a private disability policy and ERISA laws will most likely not apply.

The Employee Retirement Income Security Act (“ERISA”) is a federal law that governs all employer provided disability denials. You may have heard of ERISA, because it also governs the health insurance benefits provided by your employer. ERISA provides specific rules and timelines on how a disability insurance company must evaluate a disability claim denial. There are pros and cons to the ERISA laws, but ERISA laws tend to favor disability insurance companies. With an experienced long term disability denial lawyer there are ways to make the ERISA laws work in your favor. In our video below we discuss ERISA disability denials and how the ERISA laws apply.

A Written Appeal of Your Disability Denial May Be Required

Whether you have either a private disability denial or an ERISA disability denial, we almost always recommend the submission of an Appeal letter. Under ERISA you have 180 days to submit an appeal of your LTD benefit denial. Short Term disability claim denials also known as an STD benefit denial, may have a 30 day appeal timeline, but you can usually get up to 180 days to submit an STD appeal. An appeal letter is your opportunity to get your disability benefit denial reversed and get your disability benefits paid without having to file a disability denial lawsuit.

Our disability benefit denial lawyers have submitted thousands of long-term disability appeals on behalf of claimants nationwide. Disability insurance companies want you to rush and submit your appeal of an LTD denial, but failure to submit a strong disability appeal will almost always result your disability benefit denial being upheld.

In the video below our long-term disability insurance denial attorneys discuss how to submit a winning appeal of your disability benefit denial. You must be strategic in both the drafting of your disability appeal and in obtaining additional medical evidence to overturn your disability insurance denial. We welcome you to contact any of our disability insurance denial attorneys for a free review of your STD or LTD benefit denial.

Disability Benefit Appeal Success Stories

Our disability denial lawyers have helped thousands of claimants to get their disability insurance denial reversed. We encourage you to search our website by looking for specific information about your disability insurance company. We have a lot of helpful information that is specific to your disability company, including examples of disability appeal victories and summaries of disability denial lawsuits against your disability insurance company. We have listed below some examples of our disability benefit appeal resolved case success stories.

Unum Approves LTD Benefits for Pharmacist with Eye Disorder

Long term disability lawyer Rachel Alters discusses how she helped a Pharmacist to continue working and collect residual disability benefits from Unum. Rachel also discusses why it is always in a claimant’s best interest to contact a long term disability lawyer before you contact the disability company.

Home Depot Employee Gets Hartford Disability Benefit Denial Reversed

This case is a good discussion of issues that arise when you have mental nervous and physically disabling conditions. Hartford denied long term disability benefits three weeks before the change from own occupation to any occupation definition of disability. Hartford also denied claiming that the disabling medical condition was only for mental disabilities. This is a common denial strategy used by The Hartford. In this video long term disability insurance lawyers Gregory Dell and Stephen Jessup discuss the details of the denial and the strategies taken to get the Hartford denial reversed.

Lincoln Life Denies Disability Benefits to Operations Manager

In this Lincoln Life disability benefit denial, Lincoln relies on two of their own employed doctors to deny LTD benefits. Benefits were initially approved for 7 months. It is amazing that Lincoln ignored the opinions of 6 treating doctors and relied on their own doctors to deny benefits. In this video long term disability insurance lawyers Gregory Dell and Alex Palamara discuss the strategies taken to get this Lincoln Life disability benefit denial reversed.

IBM Executive with Occipital Neuralgia & Headaches Wins Metlife Disability Appeal

Headache disability insurance claims are commonly challenged by every long term disability insurance company. The challenge is due to the limited objective evidence available to objectively verify headaches. In this MetLife long term disability denial appeal claim, attorney Cesar Gavidia was able to get the denial reversed for an IBM executive. In this video we discuss MetLife’s reason for denying long term disability benefits and the strategies we took to win the MetLife appeal.

Research Epidemiologist with Chronic Fatigue / ME Wins LTD Appeal Against Prudential

Chronic fatigue syndrome cases are often challenged with great scrutiny by Prudential. This video with long term disability attorneys Gregory Dell and Rachel Alters discusses how we were able to get Prudential to reverse their wrongful long term disability denial. We also discuss the common challenges that claimants with Chronic Fatigue Syndrome often have to deal with when seeking long term disability benefits.

New York Life Denies LTD Benefits to 64 Year Old Sales Manager

In this NY LIFE disability denial, our client was able to win his appeal despite an IME doctor claiming that he is not disabled. It is amazing that after multiple surgeries and being age 64, that NY Life determined our client could return to work. In this video long term disability insurance lawyers Gregory Dell and Stephen Jessup discuss the strategies taken to get this unfortunate disability benefit denial reversed.

Disability Denial Lawsuit Options

What can you win in an ERISA disability lawsuit?

There are multiple outcomes in a long term disability denial lawsuit that is governed by ERISA. In the following video, LTD attorneys Gregory Dell and Alex Palamara discuss the different remedies available in an ERISA lawsuit.

Most long-term disability insurance denials require a lawsuit to be filed in Federal Court. As we discussed above, if your disability insurance denial is governed by ERISA, then you cannot file a lawsuit until you have submitted an Appeal to your disability company and given them the required time to make an Appeal decision. If your long-term disability benefit denial is upheld following an Appeal, then you must act in a timely manner to file a lawsuit. Failure to file a disability benefit denial lawsuit within either the statutory period or the time frame stated in your disability policy will forever bar you from recovering disability benefits. Most long-term disability policies require you to file a long term disability insurance denial lawsuit within either 3 years from the date your disability benefits were denied, or three years from when you were eligible to be paid disability benefits.

If you have a private disability benefit denial, then your lawsuit will be significantly different than an ERISA disability benefit denial lawsuit. In a private disability denial you will be entitled to a jury trial, whereas an ERISA disability denial is a non-jury trial and the final decision in made by a Judge. Our disability denial lawyers have handled thousands of long-term disability lawsuits in federal courts nationwide. We have extensive experience with both private and ERISA disability benefit denials. We would like to provide a free review of your disability insurance denial and determine if we can get your disability denial reversed. In our video below, our long-term disability benefit attorneys discuss what to expect in a disability insurance denial lawsuit.

Disability Benefit Lawsuit Success Stories

Tens of thousands of long-term disability insurance denial lawsuits have been filed in federal courts nationwide. Our disability denial lawyers constantly monitor the disability denial lawsuits and court decisions that are rendered daily. On our website we have summaries of disability lawsuits and court decisions against almost every disability insurance company. We encourage you to use the search feature of our website to review summaries of disability denial lawsuits against either your disability insurance company or any disability company. We think it is helpful for you to understand how courts review long term disability denials and potential outcomes in a disability denial lawsuit. Below we have listed some examples of disability lawsuit stories that you may find helpful.

A Hartford Disability Benefit Lawsuit Victory for Truist Banker with Lupus

This was an egregious Hartford disability benefit denial. Long term disability lawyers Alex Palamara and Gregory Dell discuss a successful LTD lawsuit on behalf of a former banker with lupus, back disorders and cognitive impairments. After 15 years of payments from her former employer, Hartford took over the long-term disability claim and denied disability benefits. The claimant filed a Hartford Appeal on her own and it was denied. Attorney Alex Palamara filed a lawsuit and the Hartford Disability Benefits were reinstated. In this video we discuss the reasons for Hartford’s disability denial and the steps Alex took to win this Hartford disability denial lawsuit.

Reliance Standard Disability Lawsuit Results in Payment of Disability Benefits for HR Manager

Long term disability lawyers Gregory Dell and Alex Palamara discuss a successful long term disability lawsuit after Reliance Standard denied long term disability benefits to an HR Manager with Fibromyalgia and Cognitive Impairment. In this video we discuss the basis for Reliance Standard denying long term disability benefits and the strategy long term disability attorney Alex Palamara took to win this ERISA appeal. In this Reliance Standard disability denial, they had no reasonable basis to deny long term disability benefits and ignored the approval of social security disability approval. This Reliance denial was egregious as they failed to make a time appeal decision so were forced to sue them. The outcome was great as long term disability benefits were reinstated.

Microsoft Manager Denied Prudential Long Term Disability Benefits

Our client, a Microsoft Manager, was disabled due to a rare condition called Addison’s disease. Prudential challenged our client’s disabling condition and limitations from the inception of the claim. Attorney Rachel Alters discusses the actions she took on behalf of our client. This Prudential long term disability claim was resolved in a confidential settlement following filing of a disability benefit lawsuit under ERISA.

You Can Get Your Disability Denial Reversed

Long term disability benefits denials are overturned everyday, but it takes a strategy and a very qualified disability insurance attorney to guide you. Our long term disability insurance attorneys want to review your denial letter and provide you with an immediate free phone consultation. We will give you a straight forward opinion as to whether we think we could get your disability insurance benefits paid.

In order to evaluate your disability benefit denial you will need to email us a copy of your denial letter. Based upon a review of your denial letter we can usually let you know if we can help. We never charge any fees or costs unless we win your long term disability claim. We look forward to discussing your disability benefit denial.

Resources to Help You Win Disability Benefits

Submit a Strong Appeal Package

We work with you, your doctors, and other experts to submit a very strong appeal.

Sue Your Disability Insurance Company

We have filed thousands of disability denial lawsuits in federal Courts nationwide.

Get Your Disability Application Approved

Prevent a Disability Benefit Denial

Negotiate a Lump-Sum Settlement

Our goal is to negotiate the highest possible buyout of your long-term disability policy.

Total INCOMPETENCE!!!

Not getting paid on time

Deadlines for you while theirs are ignored

Terrible Company

Extension

These people must not be human, they have no regard for people

FMLA denial after doctor who specializes in my syndromes submitted proper medical records and forms

Why Must Your Disability Insurance Lawyer Understand Your Disabling Condition?

Disability Benefit Denial Reason #5 – Your Medical Evidence is Weak

Disability Benefit Denial Reason #4 - Your Doctor Is Misled By the Disability Company

Disability Benefit Denial Reason #3 - Video & Social Media Surveillance

How Do You Fight a Long-Term Disability Denial?

Disability Denial Reason #2 - Change of Disability Definition & Vocational Review

Disability Denial Reason #1 – Paper Review & IME

How to Apply for Reliance Standard Disability Benefits & Top 5 Reasons for a Claim Denial

Seven Surgeries and The Standard Still Denies Disability Insurance Benefits

Sun Life Wrongfully Denies Disability After Paying For 23 Months

Nurse Denied Long-term Disability Benefits by Lincoln After the Definition of Disability Changed

Lincoln Reverses Decision to Terminate LTD Benefits of Corporate Attorney after Dell Disability Lawyers Appeals the Decision

Transportation Manager with Brain Injury Wins Unum Disability Benefit Appeal

Prudential reverses decision to terminate LTD benefits of MRI Tech with Primary Progressive Multiple Sclerosis and degenerative Disc Disease

Engineer With Depression Wins Prudential LTD Appeal

Estes Express Diesel Mechanic Wins New York Life Disability Appeal After Prior Law Firm Sucked

Reviews from Our Clients