Collecting Sleep Apnea Disability Benefits Is A Reality

Disability insurance carriers often claim sleep apnea is not disabling. How Can Dell Disability Lawyers Assist You?

Dell Disability Lawyers have represented long term disability claimants that have been unable to work as a result of sleep apnea. Dell Disability Lawyers have an expansive understanding of the significant restrictions and limitations that a person suffering with sleep apnea must live with on a daily basis. We have worked closely with top physicians in order to sufficiently satisfy a disability carrier’s threshold of evidence necessary to prove that a client is disabled by sleep apnea.

Not everyone suffering from sleep apnea qualifies for long-term disability benefits, therefore the medical records of each client must be reviewed to determine the level of restrictions. We welcome the opportunity to discuss your long-term disability claim. You can contact us for a free initial consultation.

What is sleep apnea?

Sleep apnea is a sleep disorder in which breathing repeatedly stops and starts. An apnea is defined as a period of time during which breathing is stopped or reduced. The severity of sleep apnea is calculated by dividing the number of apneas by the number of hours of sleep, giving an apnea index. The greater the apnea index the more severe the apnea.

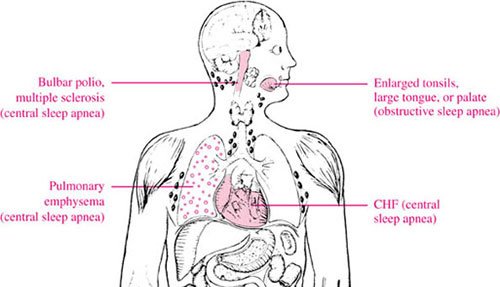

Sleep apnea occurs in two main types, obstructive sleep apnea, the most common form, and central sleep apnea. People who have a combination of both obstructive and central sleep apnea have what is known as complex sleep apnea.

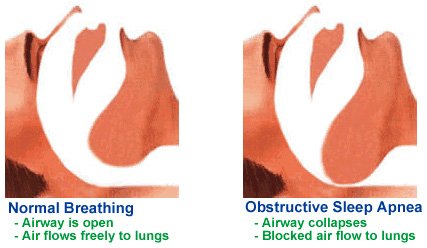

Obstructive sleep apnea occurs when the muscles in the back of your throat relax. These muscles support the soft palate, the triangular piece of tissue hanging from the soft palate (uvula), the tonsils and the tongue.

When the muscles relax, your airway narrows or closes as you breathe in, and breathing briefly stops, which lowers the level of oxygen in your blood. Your brain senses this inability to breathe and will briefly awaken you from sleep so that you can reopen your airway. This awakening is usually so brief that most people cannot remember wakening at all.

Sometimes a person will awaken with a momentary shortness of breath that corrects itself within one or two deep breaths, although this is unusual. You may make a snorting, choking or gasping sound. This pattern can repeat itself anywhere from 5 to 30 times or more each hour, throughout the night. However, most people with obstructive sleep apnea are not aware their sleep was interrupted at all.

The risk factors for obstructive sleep apnea include excess weight, a thick neck circumference, high blood pressure, a narrowed airway, being male, being aged over 65, having a family history of sleep apnea, the use of sedatives, tranquilizers or alcohol and smoking.

Central sleep apnea, which is far less common than obstructive sleep apnea, occurs when your brain fails to transmit signals to your breathing muscles. You may awaken with shortness of breath or have a difficult time getting or staying asleep. Like obstructive sleep apnea, snoring and daytime sleepiness can occur. The most common cause of central sleep apnea is heart disease, and less commonly, stroke. People with central sleep apnea may be more likely to remember being awake than people with obstructive sleep apnea are.

You may be at a greater risk for central sleep apnea if you are male, have a heart disorder such as atrial fibrillation or congestive heart failure or have suffered a stoke or brain tumor.

People with complex sleep apnea have upper airway obstruction just like those with obstructive sleep apnea, but they also have a problem with the rhythm of breathing and occasional lapses of breathing effort.

The same risk factors for obstructive sleep apnea are also risk factors for complex sleep apnea. Complex sleep apnea may be more common in people who have heart disorders.

How the symptoms of sleep apnea can affect you

The signs and symptoms of obstructive and central sleep apneas overlap, sometimes making the type of sleep apnea more difficult to determine. The most common signs and symptoms of obstructive and central sleep apneas include: hypersomnia (excessive daytime sleepiness), loud snoring, observed breathing cessation, abrupt awakenings accompanied by shortness of breath, awakening with a dry mouth or sore throat, morning headache and insomnia (difficulty staying asleep).

Complications of sleep apnea may include cardiovascular problems as sudden drops in blood oxygen levels that occur during sleep apnea increase blood pressure and strain the cardiovascular system.

If you have obstructive sleep apnea, your risk of high blood pressure (hypertension) increases 2-3 times. If a person suffers an underlying heart disease, these multiple episodes of low blood oxygen can lead to sudden death from a cardiac event. Obstructive sleep apnea also increases the risk of stroke, regardless of whether you have high blood pressure.

The repeated awakenings associated with sleep apnea make normal, restorative sleep impossible. People with sleep apnea often experience severe daytime drowsiness, fatigue and irritability. People with sleep apnea may also complain of having memory problems, mood swings or feelings of depression. They may have an increased need to urinate at night (nocturia), or suffer impotence. Gastroesophageal reflux disease (GERD) may be more common in people with sleep apnea.

For milder cases of sleep apnea lifestyle changes such as losing weight or quitting smoking are recommended. If your sleep apnea is more severe treatments may include sleeping devices such as a CPAP (continuous positive airway pressure) machine, or a BiPAP (bilevel positive airway pressure) device. Another option may be to wear an oral appliance designed to keep your throat open.

Surgical options for sleep apnea may include uvulopalatopharyngoplasty (UPPP), maxillomandibular advancenment and tracheostomy. The goal of surgery for sleep apnea is to remove excess tissue from your nose or throat that may be vibrating and causing you to snore, or that may be blocking your upper air passages and causing sleep apnea.

Other types of surgery may help reduce snoring and contribute to the treatment of sleep apnea by clearing or enlarging air passages, including nasal surgery to remove polyps, straighten a deviated septum, and remove an enlarged tonsils or adenoids.

Resources

There are many valuable sources of sleep apnea information available. You can also access resources over the internet such as: